These are difficult times for people trying to run their businesses, as governments continually impose new taxes on entrepreneurs’ operations, which means significant increases in the final price of services and products.

Most governments around the world have started taxing online platforms and digital services as these can be unregulated. Furthermore, the amount of money that governments raise is stratospheric, which has its pros and cons!

One of the most controversial taxes is the DST, a surcharge that affects digital services and increases the costs of most businesses that want to promote their products online. That’s why this article is crucial for Google advertisers who want to know how to deal with this closure!

In this article, you’ll learn the following:

- What is the DST fee, and how it can affect your business.

- Countries where the DST is applied and the percentage of that tax.

- How to track the DST on your Google Ads account.

- What Is the DST Fee?

- Which Digital Advertising Companies Charge DSTs?

- Which Countries in Europe Charge Digital Services Taxes?

- And What About The United States?

- How Does Google Calculate Jurisdiction-Specific Surcharges and DST Fees?

- When Can Google Charge Surcharges

- Where Can You Check These Surcharges?

- How Can You Pay DSTs? Alternatives

- Manage Your DSTs Together With a Professional Marketing Agency

What Is the DST Fee?

Source: Taxobservatory.

DST stands for Digital Service Tax. It is a type of jurisdiction-specific surcharge, such as the Regulatory Operating Cost and others, that countries have started to charge for operations that online users carry out on the Internet, such as purchases or advertising.

Not all countries apply DST or Regulatory Operating Costs to online operations. It will depend on the legal regulations of each country, state, or jurisdiction. Still, if you notice that your Google Ads account has started to charge for DSTs, it’s probably that your country has changed the law and started to collect these taxes.

Google may charge regulatory operating costs or DST fees in addition to your advertising costs every time a user interacts with your ads in specific jurisdictions, regardless of the location of your actual business. These new surcharges are associated with the cost of doing business when a user interacts with your ads in these jurisdictions.

In most countries, DSTs correspond to the Value-Added Tax of targeted locations. In other countries, you will pay it as an extra tax in addition to other taxes, such as the Goods and Services Tax and general sales taxes. For this reason, Google advertisers must check the particular reality of the countries or regions where they will promote their products.

Note. Surcharges apply to ads interacting with Google Ads and to YouTube placements purchased on a reservation basis.

Which Digital Advertising Companies Charge DSTs?

While Google enforces digital services taxes, other companies take different approaches. Facebook, for instance, doesn’t transfer the DST burden to its customers, while Microsoft follows a similar practice. Amazon, on the other hand, applies a flat 2% fee across all customers located in affected countries.

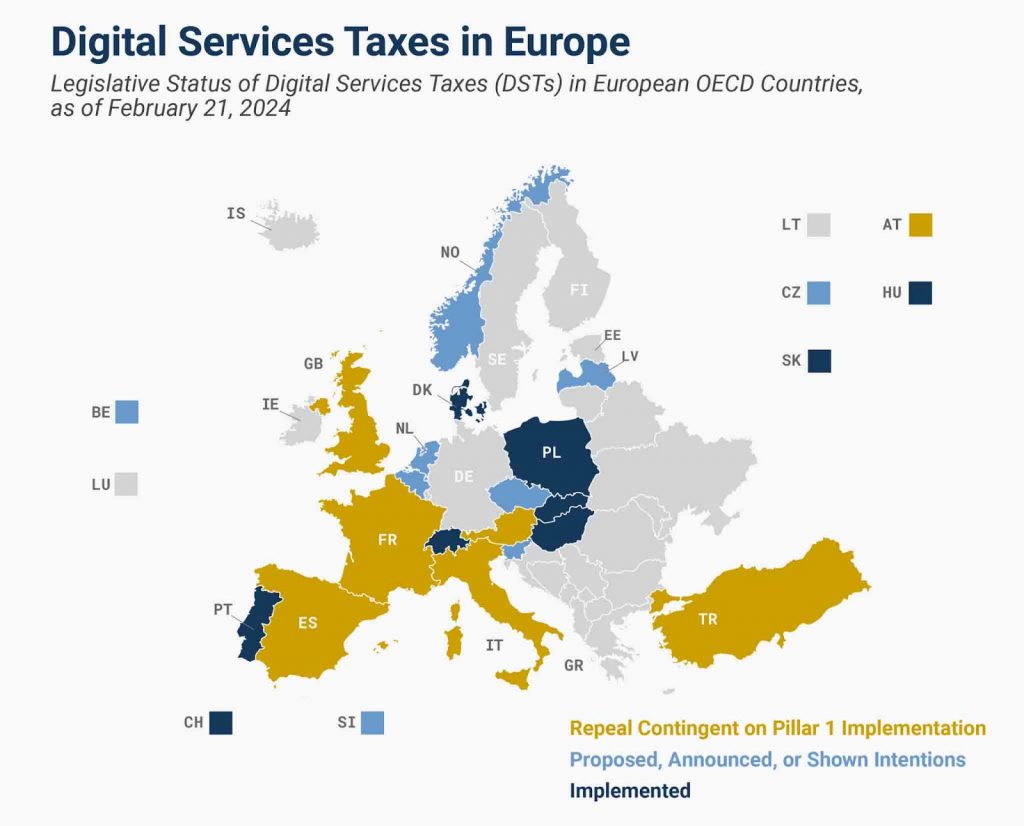

Which Countries in Europe Charge Digital Services Taxes?

Source: Taxfoundation.

Almost half of Europe’s countries have implemented a DST fee regulation. However, several additional countries have proposed, announced, or shown intentions to implement this tax in the subsequent years.

The countries that have implemented these additional fees are the following:

| Country | Scope | Tax Rate |

| Austria | Only advertising | 5% |

| Denmark | On-demand, audio-visual media service providers | 3% |

| Hungary | Advertising revenue | 7.5% |

| France | Provision of a digital interface | 3% |

| Italy | Advertising on a digital interface | 3% |

| Portugal | Audiovisual commercial communication on video-sharing platforms, subscriptions for video-on-demand services | 4% |

| Spain | Online advertising services | 3% |

| Slovakia | Payments to digital platforms to facilitate transport and lodging services not registered as PE | 5% |

| Turkey | Online advertising, sales of content, and paid services on social media websites | 7.5% |

| Switzerland | Income generated from streaming or television services | 4% |

| The United Kingdom | Social media platforms | 2% |

Tip. Note that the UK DST fee is one of the smallest you can find in Europe.

And What About The United States?

Despite the fact that The United States is divided into several states and there are several federal-level laws, there is no federal regulation regarding sales taxes or digital services taxes. In this sense, each state, county, and city has the option to apply the sales tax and DST it deems appropriate.

Key features:

- The United States does not adhere to any universal definition of sales taxes.

- The United States does not charge all digital goods and services the same.

- The United States has over 13,000 different jurisdictions.

- Thirty-eight states in the United States have local sales taxes.

- Forty-five states and D.C. have general sales taxes.

In a nutshell, the taxability of digital services in the USA varies by state, and localities may have the authority to levy and administer local taxes.

Approximately 30 states tax some type of digital services but just a few tax them across the board.

How Does Google Calculate Jurisdiction-Specific Surcharges and DST Fees?

Source: Support.google.

Since many Google advertisers can overlook this new digital services tax and other surcharges, it’s important to know how the American giant calculates these values in order to manage your digital economy better.

According to Google support, Google will charge you based on the number of ad impressions and effective clicks your ads receive in a particular jurisdiction. On the other hand, if you’re advertising in other countries in addition to yours, you’ll only pay when your ads are served to the people in those countries.

Important: Keep in mind that you’ll pay for every target location where the DST and ROC fees are applicable Also, consider the sales tax to calculate the final amount you’ll pay.

When Can Google Charge Surcharges

Google adds the surcharges to your account at the end of the month, when you finish the tax period. However, you’ll just have to pay the next time Google charges you.

Surcharges are always added to the account budget if the account owner has set one up. This action ensures that the payment of surcharges and taxes is aligned with the country’s regulations and laws.

Google doesn’t differentiate between legitimate impressions and clicks that occur outside your targeted locations, even if they don’t benefit your business. For instance, if your ads are displayed in locations you haven’t specified for advertising, Google will still impose charges, regardless of their relevance to your business.

Where Can You Check These Surcharges?

Source: Investopedia.

You can check all the surcharges of your campaigns in the following places in your Google Ads account:

- In your monthly statement or invoice. Here, you find surcharges as a separate line item per country or jurisdiction.

- In the “Transactions” menu of your Google Ads account.

To check which countries or jurisdictions your ads are served in, you must create a custom report within your campaign settings by following these steps:

- Create a predefined “Distance” report.

- Delete all default rows.

- Add a “Country/Territory (user location)” row.

How Can You Pay DSTs? Alternatives

In general terms, you have two alternatives when it comes to paying this digital services tax: manual payment or automatic payment. In the first option, you will pay it manually together with the general Google Ads costs at the end of the month, as we mentioned above. In the second way, Google automatically deduces the amount from your open balance. If your payment has been fully spent, Google will charge these surcharges later.

Example:

If you’ve made a payment of $50 for your ads served, and the accumulated digital services taxes rise to $10, then you’ll have a credit of $40 towards deploying ads in the next months. In other words, you’ll have an open balance of $40.

Manage Your DSTs Together With a Professional Marketing Agency

As a good Google advertiser, you must be up to date with all the news related to Google and the country’s regulations, as these can directly affect your business and your profits. Remember that DST rates are strictly related to clicks and impressions served and that surcharges apply to ads purchased through Google Ads, so the more impressions and clicks you get, the more you will pay at the end of the tax period.

Consider these taxes when implementing your Google Ads marketing campaign. Still, you can always trust a professional marketing agency like GamerSEO that is constantly aware of these issues. Contact the GamerSEO team to discuss your marketing strategy and evaluate taxes and other factors that determine your ads spend!

Maciej is a content manager with five years of professional experience. While his heart beats for viral marketing campaigns and creative storytelling, he’s equally at home delving into data to craft compelling content. Off the clock, you’ll find him immersed in old-school RPGs or doing various sports activities