If you’ve already used a trading platform like Binance and checked the online trading system, you’ve noticed hundreds of numbers, graphs, and more. One of these graphs is a sell wall. But what does this concept mean? What Is a Sell Wall? Today’s article addresses this relevant brick in the general trading wall.

What Is an Order Book?

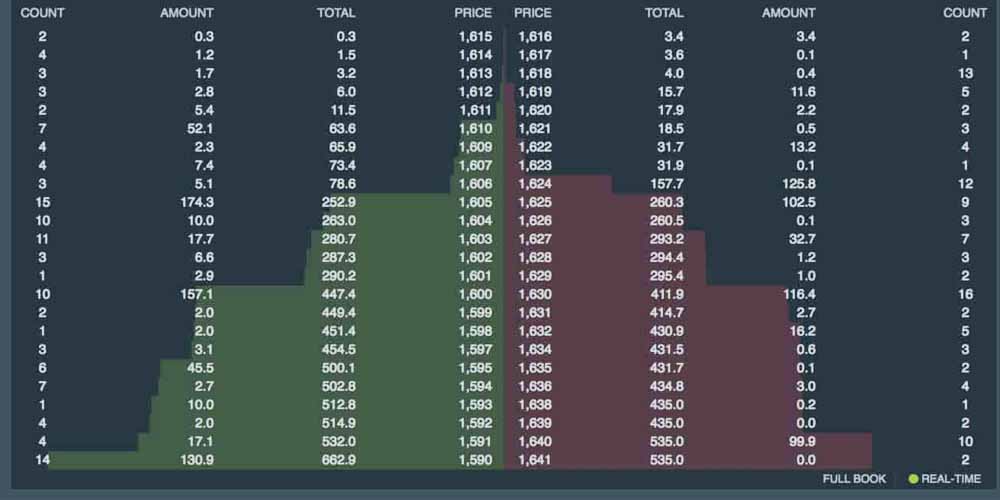

An order book is a register of the orders placed on the market and waiting to be executed. It’s an electronic list of demands for a financial instrument or specific security. Price levels organize an order book.

In the order book, you can easily check the buy or sell orders and the market depth.

The exchange operation is carried out when buy and sell orders have the same price.

A significant advantage of order books is that you can quickly check and track large orders, buy or sell orders, and understand how the market behaves.

What is a Buy Wall?

As you might expect, this wall corresponds to a big green area. It indicates the number of buy orders that are currently on the market. In other words, it appears when there are more buy orders than sell orders.

When deep charts are majority green, it’s a good indication of the health of the digital asset of cryptocurrency.

A buy wall is a clear indicator of several things:

- It probably indicates an increasing upcoming price;

- There are multiple orders at the same price;

- Or a big company holding a large number of cryptos is carrying out price manipulation.

When enough people tend to buy assets at a certain price, a seller with enough assets (sometimes they hold thousands of them) can sell them under market pressure.

What Is a Sell Wall?

A sell wall is a red area in market depth charts and the opposite of a buy wall. A sell wall appears when sell orders are over buy orders. This sign indicates that many traders are more interested in selling than buying.

It can indicate a problem with the digital asset or an upcoming price downturn shortly. It can also suggest that if the market price has peaked, it’s time to sell. This is when you collect the profit of your investment.

The term sell wall refers to a considerable limit sell order or a cumulation of sell orders at one price level on an order book.

When you see a large limit order in the sell wall (a clear vertical line), sellers are only willing to sell their assets at a specific price.

The sell wall’s price moves according to the asset’s demand and value in international trading markets.

The Market Depth Chart

A market depth chart is a beneficial tool that helps you visualize buy and sell orders in the form of buy and sell walls. This chart provides a clear vision of the market sentiment. Thanks to this, you can identify buy walls – the orders looking to buy at a specific price (bids) – and sell walls – the orders looking to sell at a particular price (asks).

The Market Depth chart gives a quick overview of how people feel about different price points of the instrument.

Depth Charts are built of four key components:

- Bid Line: This is represented by a green line on the green section of the chart. It indicates the cumulative value of the buyer orders at a given price point.

- Ask Line: This is represented by a red line on the section of the same color. It shows the cumulative value of supply at any price point.

- X-Axis: The horizontal axis in the part below indicates several price points at which buy and sell orders are placed. Most trading platforms show X-axis in dollars.

- Y-Axis: The vertical axis depicts the financial instrument or cryptocurrency you will trade. It indicates the number of pending orders placed at each price point.

Note. If the green block is higher than the red one, it is clear that the cryptocurrency is desirable for many investors. People are interested in purchasing it to gain control over their assets until their value increases.

Buy or Sell Walls: How to Identify Them

You may find two types of buy and sell walls: real and fake. Real buy or sell walls may be due to psychological barriers or the necessity of buying or selling, depending on the asset’s price. On the other hand, fake buy and sell walls may be built for crypto manipulators, big traders that can create a phony stock wall, and so-called “whales.”

Whales can manipulate an order price by holding many cryptos, creating a buy or sell wall. Market manipulation is widespread in cryptocurrency markets, so you should be aware of any large sell order you find.

These accumulations show that a large number of holders have the intention of selling their digital assets at one price level. So, it’s practically impossible for a price to move until all the assets are sold.

For instance, if a whale places a sell order of 10,000 BTC at a low price, say at USD$2,000, many traders will head to the market to buy as many as possible. This way, the order book will show a big sell wall at this price that prevents it from going above USD$2,000.

How Can I Know if a Whale is Trying to Manipulate Prices?

The best is to check technical analysis and keep up to date with the news of the particular

cryptocurrency you’re trying to buy or sell as a trader. When you see a large volume of buy or sell orders in the context of little changes in public sensation, you may be pretty sure that the market is easily manipulated.

You can also consult other traders, buyers, and sellers and study the graphical representation of trading decisions in the market depth chart. When walls are intentional, there are round numbers that set a barrier that is impossible to move. Here, whales aim to manipulate the price, either the sell or buy side.

One of the best examples is Elon Musk and his tweets. After adding #bitcoin to his Twitter bio, the value of the most popular digital coin in the world increased by 14% in January 2021.

However, one of the most prominent tweets appeared on June 19, 2022. Musk tweeted: “I will keep supporting Dogecoin.” Shortly after, the Tesla CEO got sued for $258 billion for allegedly running a pyramid scheme for a cryptocurrency that has recently acquired popularity among investors.

Although the benefit may be significant, it’s better to be aware of any big order in the electronic list and wait for subsequent movements.

Two indicators show that a market might be being manipulated to create selling or buying pressure.

If a Wall Appears from Nothing and Quickly

If you’re continuously entering the trading platforms to check the order books, and you suddenly see a big wall appearing, then that is a sign of a manipulated wall. Sometimes, whales create a fake demand to sell their digital assets at a good price and get more money for their virtual properties. This apparition is typically a sign of a faux wall.

If Walls Are Removed Continuously

This sign derives from the previous one. If you notice that order book lists and walls are removed and replaced all the time, it is a sign that large amounts of assets are being injected into the market for a single institution or a whale.

If an Order is in the Order Book for a While

In most cases, when an order or several orders are in the order book for a while, there is a genuine interest in purchasing or selling stocks at a determined price. On the contrary, if numerous orders are placed in the blink of an eye, a whale probably creates the demand.

Bottom Line

Trades are complex, requiring much knowledge about how the market works, buy and sell orders, exchanges, liquidity, and other factors. Sell walls are an essential part of the trading system, and their influence will make you decide whether to buy or sell and take a risk regarding your capital.

With our quick glance at this article, we hope we’ve contributed to your expertise and made a difference. Still, you can check other trade-related articles since we have a strong presence on this subject.

Browse our blog for more articles and learn more about the leading community of cryptocurrencies, NFTs, gaming, and more.

SEO enthusiast and digital marketing strategist. My expertise lies in optimizing websites for organic traffic growth and search engine visibility. I carry out, among others, SEO tests, keyword research and analytical activities using Google Analytics. Privately, he is a lover of mountains and bicycle trips.