When dealing with cryptocurrency, there are lots of things that we must pay attention to every day, if we want to trade crypto without losing our money. When dealing with such a volatile market, you must understand and pay attention to terms like crypto trading volume and the dollar value, for example.

With this in mind, if you are thinking about starting as a crypto investor, there are some basic concepts that you should know before doing anything with the crypto market. This way you avoid rising prices and understand who your potential buyers are, leading you to a career of high success in this business that grows more and more everyday.

If you want to be at the top in this industry, be sure to understand all of these concepts and apply them to your daily trades and market research. Knowledge is the most important part of this entire process.

What Is Trading Volume

The simple way to describe trading volume is by saying that it’s the sum of what is being bought and sold on the market, referring to specific crypto. This way, the cryptocurrency volume of trades will impact the future price of a particular coin.

Paying attention to volume data will also show lots of information about the market participants and the money flow index. The technical analysis of these data can also make you one step ahead of your competitors by elucidating new market opportunities and price movement tendencies.

High Crypto Trading Volume

The high trading volume indicator isn’t always a good thing, especially when considering your next investment’s price direction. Although it might bring good investment results on a particular coin and also shows high demand for a specific cryptocurrency, high trading volumes also can be technical indicators for falling prices.

The high volume does not match a high price movement every time. A great example of this is the bear market, where lots of investors run to sell specific coins and assets, generating a significant volume that precedes a falling price of a particular cryptocurrency.

Low Crypto Trading Volume

This is normally a bad sign in volume indicators. The low trading volume shows a lack of interest from the investor and other traders.

It indicates that a small portion of the investors wants to buy or sell coins attached to that specific cryptocurrency in that time period. But the lower volume indicators also have a good side, since they can also turn into highly profitable deals with a drastically increasing dollar value of that particular coin. This is why many investors like those deals, possibly becoming an investment with high reward because of its volatility.

The Liquidity Effects on Cryptocurrency Volume

This is a very important topic when thinking about volume indicators and crypto prices in general. Liquidity refers to how easily a token or asset can be transformed into another digital asset or cash, without impacting their prices.

It is an important metric for technical analysis and daily volume changes. One example of this is bitcoin’s daily trading volume, which thanks to its 200 billion dollars worth of liquid assets, can survive huge liquidity drains without crashing.

Best Indicators When Doing Volume Measurements

When dealing with cryptocurrency volume and making measurements, some indicators are indispensable to have precise results. This is a major part of avoiding volatility and having a good track of market capitalization and time frame.

With this in mind, here are the best indicators to use when measuring the volume of a cryptocurrency and doing a technical analysis of it:

Money Flow Index on a Volume Indicator

The MFI is an indicator that runs from 0 to 100 used to show overbought and oversold coins and assets in the cryptocurrency market. If the value is equal to 80 or above, it indicates an excessive buying volume that will lead to a price reversal. On the other hand, if the price is equal to 20 or below, it indicates excessive sellings, leading to oversold conditions.

Even though the MFI is one of the most commonly used technical analysis tools in the cryptocurrency world, it is important to know that there are others like it.

On Balance Volume

The OBV is another essential metric when analyzing the volume of a cryptocurrency and the balance volume. It is the most used one due to its simplicity and the possibility of personalizing its range of it.

Be aware that the long-term information that it provides should not be considered during the crypto volume analysis since the calculations of the measured volume are reset daily. There are tons of tools that provide an OBV analysis of increasing volume in crypto, including both options. Be sure to check them out and decide which one fits your workstation best.

The Problem of Wash Trading

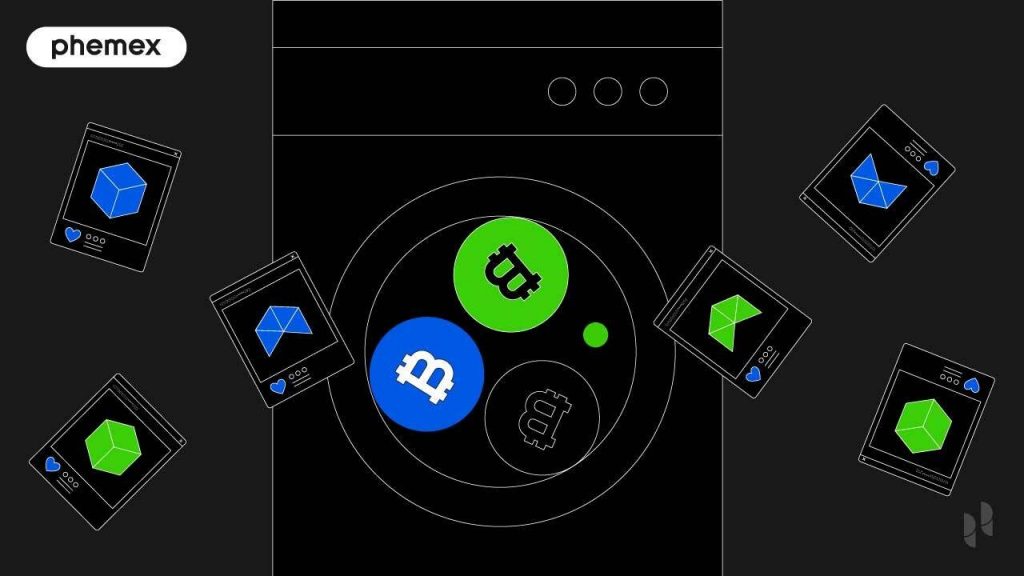

When measuring things like total volume traded and almost any other data from your technical analysis, the wash trading practice can end up giving you fake results on a given cryptocurrency and its price. This is a really common practice in cryptocurrency trading and market capitalization.

Wash trading consists in buying and selling the same coin multiple times in a given period. This way the sellers end up creating an appearance of high volume, to make future prices increase.

It is also good to remember that this is an illegal practice. The traders that do this use multiple account addresses to hide identity and make data tracking more difficult.

Causes of a Raise or Decrease in the Total Volume

Besides the technical analysis details and knowing how to measure volume, it is also essential to understand what makes the prices rise or decrease and, consequently, achieve a greater volume, or the opposite. The answer is third-party involvement in projects.

When a project reaches a new cycle or announces a new partnership with third-party companies, the prices normally spike up or down, reflecting the community and traders’ predictions on the situation. Based on this people decide what to do with the coin or asset, between buy and sell, causing the spike.

Conclusion on What Is Volume in Cryptocurrency

It is clear that volume is one of the most important aspects of trading cryptocurrencies and price checking. This is why the analysis of the sum of what was bought and sold of specific crypto matters so much for the sellers and anyone else who wants to trade coins.

It is correct to say that this is the most important metric, due to the volatility of crypto trading. Having a good analysis of the latest transactions of a given cryptocurrency in a given period should lead you to a clear result and a good indicator of what to do next and where to invest.

Next Steps as an Investor

Now that you have all the knowledge you need about measuring volume, it is time to choose a project to analyze. Take a long time observing the market and its tendencies to decide which asset is the best for you to invest in.

Look out for all the details that precede a good project with a high chance of success. Also, be sure to look for the ones that fit your budget and have a greater chance of giving a return. There is no specific price in this market, everything changes in the blink of an eye.