When you are constantly dealing with the blockchain, whether through non-fungible token sales or crypto-transactions, it is always good to know what tokenized assets are and their types. It can also make your work easier by understanding more about blockchain technology and technical terms like smart contracts and fractional ownership, for example.

What Is Asset Tokenization?

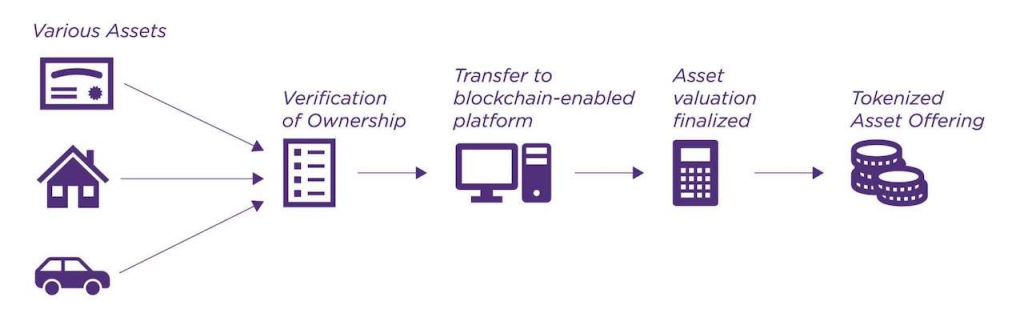

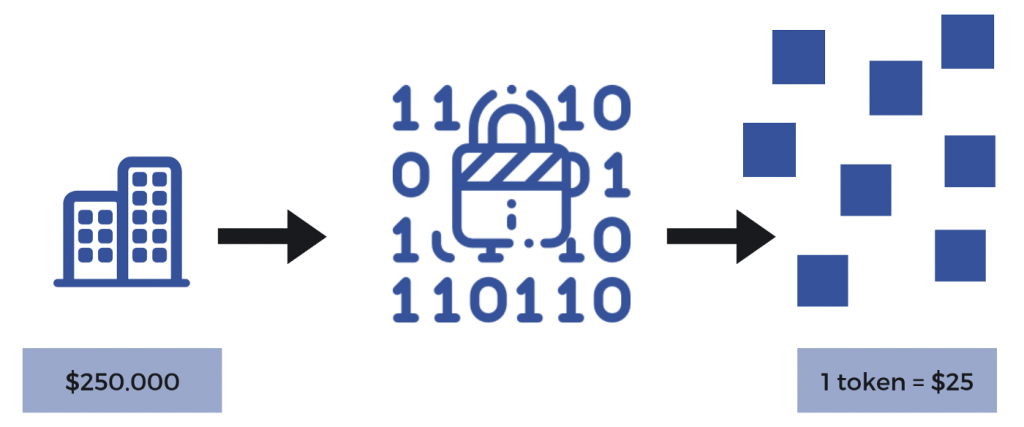

The asset tokenization process consists in transforming an asset into a digital token in the blockchain, enabling the sale, exchange, and purchase of this specific asset. The process itself is a little more complicated than that and involves steps like issuing security tokens, which represent digital tradable assets.

This practice allows users to easily manage and monetize valuable physical objects, transforming them into intangible assets. It’s the digital version of a practice that we see every day with physical assets, like Pokemon cards exchange or buying a piece of art, for example.

Why Have Tokenized Assets?

There are tons of reasons why transforming your physical assets into tokenized assets is a good idea. The first reason is that by knowing how to do this, you achieve secondary markets and raise funds in new and innovative ways.

Another reason for the tokenization of real-world assets is that you can also expand the offer of items, generating more income from the same product twice. The non-fungible tokens are a great example, where you can sell a physical version of the item and then additional tokenized assets of the same item.

Types of Digital Tokens

It is also important to know that there are several different types of tokens, each with its function. Knowing when to use each type is an important step in learning about asset tokenization.

These are the most common types of tokens that you may find throughout the blockchain:

Utility Tokens

This is the most common type of token regarding the exchange and selling of assets. These tokens are used to secure project funding, being characterized as the cryptocurrency of the project, no matter which blockchain the digital assets are inserted on.

Security Tokens

As one of the most important types of token, it requires a register to issue virtual shares and can be subjected to laws, affecting both the token holders and the secondary market. The main difference between this and the unity token is that the unity tokens are not recognized as securities and don’t involve measures like those.

Wrapped Tokens

These are more commonly used for cross-chain activities since they are the tokens used for having native tokens outside of the native blockchain. The value of these tokens stays the same as the original, so you don’t have to worry about the conversion or anything related when using them.

Non-Fungible Tokens

The most famous kind of token because of the market’s high demand. The NFT is a digital asset that perfectly matches the next one, creating identical yet different tokens.

These tokens can only be exchanged for an identical one. This means that when you have one Ethereum, it is equivalent to one Ethereum and will only be exchanged for one Ethereum.

How to Tokenize an Asset

The entire process of asset tokenization will depend on what you are trying to tokenize. It can be a simple physical object or a more complicated thing, like an entire company, so the process and its steps may vary depending on this point.

Here we will show you the main steps for creating tokenized assets and what to do. But be aware that depending on what you are trying to tokenize, it may cause extra steps or even a completely different process.

Asset Audition

The first step of the process is to choose the physical asset that you want to tokenize. From illustration to intellectual property, or even commercial real estate, almost anything can be tokenized.

No matter your asset of choice, the first step is to audit the object to verify its characteristics and value. This is the first asset management step in order to determine its worth.

Token Choice

The next step is to choose what kind of token you want your asset to be transformed into. No matter if you are planning on creating security tokens or any other kind, you have to choose the type that fits your assets and expectations when it comes to trading, selling, etc.

It is also important to remember that modern blockchain technology allows you to have multiple token options when deciding its category. This allows you to create it based on your objective with the asset created, no matter if it’s for retail investors or selling on primary and secondary markets.

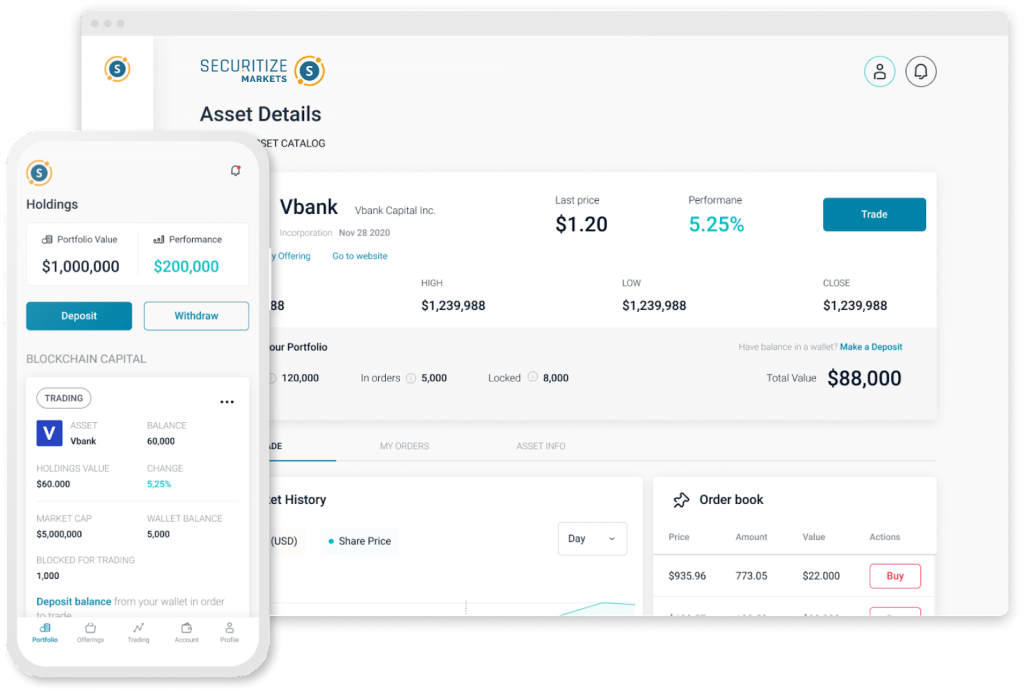

Platform Choice

Now it’s time to choose where you want to make the entire process. There are dozens of platforms online that offer the service, each with its focus. Choose one that matches the previously mentioned points and fits your asset tokenization needs.

Since the tokenized asset can change, be sure to use a platform that works with what you are trying to do. And also use a platform that has great knowledge of the process and its details, like distributed ledger technologies.

Smart Contracts

Another important step of the asset tokenization process is the creation of smart contracts. The platform automatically does some details of the asset ownership and digital representation, but there are other details that you must do by yourself through smart contracts.

The initial token offering and the number of tokens that will be available for public distribution are some details you must consider when working on the contract. You’ll also have to decide the number of smaller parts that compose each token you are distributing.

Tokenized Assets Vaulting

Now the holder of the digital asset leaves the item to the third-party service provider that will store it properly and verify its authenticity. This is very different from real estate storing. Here the tokenized asset will stay in a properly prepared storage with great security and environment maintenance.

Token Distribution

This is the last step of the process, where the asset holder will list their tokens. Don’t worry about the issuing process because the tokenization platform does it for you without any problem.

After the entire process of asset tokenization, it’s time for you to decide what to do with them and start the token distribution. From trades in secondary markets to investment funds, there are tons of options for you to decide which one fits your objectives with asset tokenization.

Most Famous Asset Tokenization Platforms

When doing the asset tokenization process, there are dozens of platforms to choose from. This may confuse the user when thinking of security, credibility, and lots of other aspects of tokenizing a traditional asset.

The main advantage of the tokenization platform is to increase the liquidity of the tokenized asset. The market involved in this business is currently showing a massive volume of illiquid assets. With this, the sellers and consumers take longer to learn about each other’s services.

Thinking about this, here are the most famous platforms to help you tokenize your tangible assets:

Ready to Tokenize Assets?

Now that you learned everything about the asset tokenization process, it’s time to use this knowledge and start making your own tokens. No matter if you want to make traditional assets, financial assets, or any other kind, be sure to read and pay attention to your country’s laws about tokenization.

Think of your objectives and ambitions as asset owners and then choose the best strategy to achieve these goals. From security token offerings to your investment fund, watch every step of the process to avoid any errors that may occur, like in the smart contract.

SEO enthusiast and digital marketing strategist. My expertise lies in optimizing websites for organic traffic growth and search engine visibility. I carry out, among others, SEO tests, keyword research and analytical activities using Google Analytics. Privately, he is a lover of mountains and bicycle trips.