“Cryptocurrency exchange” and “cryptocurrency wallet” are one of the most used terms in the crypto industry. Some even use these terms interchangeably, not knowing they’re not the same thing.

People easily confuse one with the other, especially those taking their first steps in the crypto world. However, the two have significant differences, and you should be aware of them if you call yourself a crypto enthusiast. Also, you’ll know which is the most suitable for your needs.

What is Cryptocurrency Wallet?

As the name implies, cryptocurrency wallets are used to store cryptocurrencies. Like a bank account, where you store your funds. There are two major types of wallets where you can store crypto – hot wallets and cold wallets.

- Hot wallet. A wallet connected to the internet. Available as a software program or as a feature on several crypto exchange websites (known as exchange wallet). It’s a convenient solution for executing crypto transactions. However, online wallets are prone to hackers, so it’s not the best long-term solution to store bitcoin, for example. Some hot wallets offer a form of repayment for stolen crypto, so make sure to check it beforehand.

- Cold wallet. A hardware wallet designed to store crypto physically, with no need for an internet connection. They come in several form factors, even USB sticks. It’s the safest storage for your crypto keys. There is no risk of hacking whatsoever, but you miss on additional trading and integration features among hot wallets. Also, if you happen to lose it, there’s no way of getting your crypto back. It’s just like losing a wallet filled with cash.

Keep in mind that you can store the same coins in multiple wallets. It means you can have the same tokens or coins in both cold and hot wallets. Having both gives you access to at least one of them if something happens.

Whatever you choose, any wallet’s purpose is to store the “keys” to your crypto. That key is an encrypted string of characters used to sign transactions. With a proper key, you will have access to your crypto stash. Your currency relies on both public and private keys, so you’ll need both. Compatibility between wallets is also key if you want to access additional features.

Cryptocurrency wallets examples:

- Coinbase

- MetaMask

- TrustWallet

- Ledger Nano S Plus (hardware wallet)

- Electrum

- BlueWallet

- Exodus

- Crypto.com

Pros:

- High-security level…

- Easy access.

- Long-term crypto storage.

Cons:

- …but there’s still a risk of getting hacked if you’re not careful with your private keys.

What is Cryptocurrency Exchange?

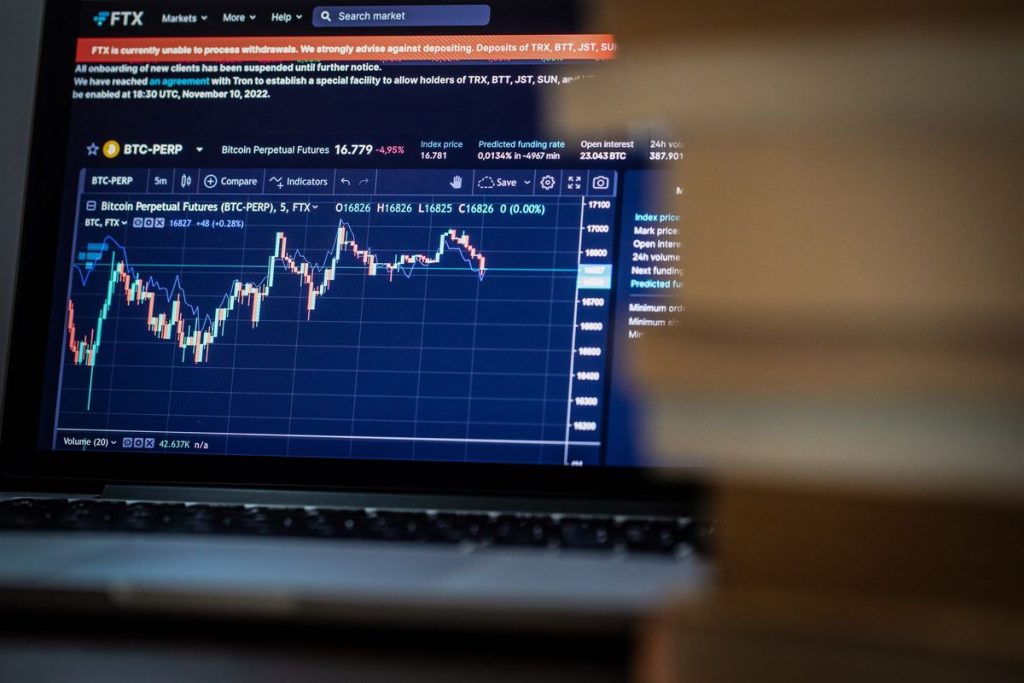

A cryptocurrency exchange is a website or service where you can sell and buy digital currency, as well as convert fiat currency to digital currency. If you’re familiar with the stock exchange, then you’ll notice that market rates fluctuate similarly. They also have exchange wallets that work similarly to crypto wallets. To access it, you have to create an exchange account and sign in.

With exchange, you have access to all crypto account information. You can check your current balance, sell crypto, and make trades from your account. Crypto exchange is your digital bank. There is a major risk, though. Cryptocurrency exchanges are decentralized in most cases, meaning they are not subject to any entities. So if the exchange gets hacked or the owners decide to trade the currency and runoff, there’s nothing you can do about it.

However, this is the worst-case scenario, and you’d have to be really unlucky nowadays for that to happen.

Centralized Exchange

With a centralized exchange platform, you can buy and sell cryptocurrencies for fiat currencies and digital assets like BTC, ETH, and more. They are trustworthy brokers in deals and serve as custodians safeguarding your funds.

Centralized exchanges examples:

Pros:

- User-friendly interface and simple platforms.

- Solid security and trustworthiness.

Cons:

- Service fees.

- Controlled by a centralized entity, meaning it can be shut down.

Decentralized Exchange

The main difference here is that decentralized exchanges are independent of any entities. No one is in charge of the assets. Also, smart contracts and decentralized apps are used to automate transactions and trades. Provided the smart contract is properly constructed, no security breach is possible.

Decentralized exchanges examples:

Pros:

- Private and anonymous.

- You don’t have to transfer assets to a third party.

- Fees are going to liquidity providers, not a centralized entity.

Cons:

- Can’t trade with fiat currency.

- Risk of losing liquidity providers.

- Due to thin liquidity, it may be hard to execute larger transactions.

Decentralized Exchange vs Centralized Exchange

Since you learned how centralized and decentralized exchanges work, it’s time to compare one with the other.

| Feature | Centralized Exchange | Decentralized Exchange |

| Ease of use | User-friendly | Complicated |

| Security | Risk of being hacked | Risk of Smart Contract exploit |

| Features | Many features | Limited features |

| Speed | Instant | Orders must be confirmed on blockchain |

| Fees | Standard fee | Gas fees |

| Trading volume | High | Low |

| Liquidity | High | Low |

| Regulations | Easily regulated | Complicated regulation |

| Fiat payment | Yes | No |

As you can see there’s no perfect solution, so choose according to your needs.

Crypto Wallet or Exchange?

Crypto wallets were made to safe-keep your digital assets, while with the exchange, you can facilitate trading from one coin to another.

What crypto wallets are for:

- Long-term crypto storage.

- Unlimited access at any time.

- Secure your cryptos.

What crypto exchangers are for:

- Buy and sell crypto.

- Convert fiat currency into cryptocurrency.

- Sending crypto to a wallet.

Exchanges are perfect for short-time storing and trading cryptocurrency conveniently. For long-time storage, we advise transferring funds to a wallet where you are responsible for securing, backing up, and managing your crypto. That’s the benefit of knowing the difference between the two – proper management of your funds.

| Cryptocurrency wallet | Cryptocurrency exchange | |

| Definition | Refers to a program that allows investors to store all their cryptocurrency. | Refers to a website or service where you can sell or buy digital currency or convert fiat currency into digital currency. |

| Control over the private key | Allows full control over your private key. | Doesn’t allow full access over your private key. |

| Other features | Do not offer features such as selling, buying, or trading. | Offer crypto selling, buying, and trading. |

Link Trading Platform to Crypto Wallet

As we said before, crypto exchange and crypto wallet complement each other, so it’s best to learn using both. Of course, different platforms have different interfaces, but the general rules are the same. Follow our guide if you want to use a wallet for trading crypto assets on an exchange.

- Sign in to the crypto exchange of your choice.

- Check the cryptocurrencies available for sale.

- Choose a currency you want to convert and how much you wish to buy or sell.

- Open your crypto wallet. You can use a desktop program (software wallet) or a mobile device.

- Send information to the exchange. Your public key will show the site you’re looking to make the transaction. You have to copy and paste the key or scan the QR code with a mobile device.

- The transaction should appear on the blockchain after a while.

- Every transaction comes with a fee. They vary between different exchanges, so read the terms to know what to expect.

Conclusion

Choosing between a crypto wallet and an exchange is one of the main decisions you eventually have to make. Both are good for storing cryptocurrencies, so it’s up to you to decide which one will benefit you in the long run. The more experienced you become, there’s a high chance you’ll own both.

The bottom line is as follows: if you want a wallet-less exchange or exchange with a built-in wallet, only keep funds that you’re actively trading with. However, if you’re keen on keeping the coins for longer periods of time in the hope of making a profit in the future, it would be wiser to withdraw them and keep them in hardware wallets.

There is no ideal solution for digital currency management; each has pros and cons. Before opting for a wallet vs exchange, always evaluate the risks when jumping into cryptocurrency investing.

SEO enthusiast and digital marketing strategist. My expertise lies in optimizing websites for organic traffic growth and search engine visibility. I carry out, among others, SEO tests, keyword research and analytical activities using Google Analytics. Privately, he is a lover of mountains and bicycle trips.