Just like other assets and tokens, cryptocurrency can be traded in several markets and ways, including crypto derivatives. These provide security and flexibility and are used for hedging and speculation. They also offer more opportunities when investing in digital assets. In this article, we address the most relevant aspects of derivatives. This way, you can consider them in your next investment.

What Are Crypto Derivatives?

Derivative trading is a common way of determining the value of a specific product or asset where two parts of the transaction try to agree on the future trading price.

Derivatives are risk management tools that you can leverage to minimize risks when you trade cryptos. Leveraged contracts allow you to set a price and be sure you’ll receive an asset at a specific cost.

The value of a derivative is determined by an underlying asset, for example, cryptocurrencies, commodities, stocks, exchange rates, etcetera.

The objective of the agreements between both sides of the transaction is to earn profits by waging on the future’s value.

What Are the Types of Crypto Derivatives?

There are mainly four types of crypto derivatives through which you can invest in cryptocurrencies. Below we mention them and give some valuable examples.

Crypto Futures

A Futures Contract is one of the most used ways of agreeing on the value of an asset in the future, and in the case of cryptocurrencies, the story is not different. In the crypto market, buyers and sellers can agree on a specific crypto at a specified date and at a specified price.

One of the most celebrated contracts is the Bitcoin Futures contract, through which investors are obligated to buy or sell this valuable asset at a specified price and date. But still, you can do this with any digital asset class.

How Can I Trade Crypto Futures?

The first thing a trader must do is to determine the contract’s duration. That said, you must decide if you want a weekly, bi-weekly, quarterly, or monthly contract. Most crypto markets give you these four possibilities and more.

You can either bet on the price of the crypto increasing or decreasing. Whatever the case, decentralized or centralized platforms will match you with other traders who go in the opposite direction when betting. When the expiration date arrives, one of the two will have to pay up depending on the price change.

Crypto Options

With crypto options, a trader or crypto holder has the possibility–not the duty–to buy or sell a particular crypto at a defined price and future date.

How Can I Trade Crypto Options Contract?

Unlike futures, options provide you with a “right” but not an obligation to purchase or sell such assets. The options available are “Call”–when you want to buy assets at an agreed price–and “Put”–when you want to sell.

For instance, you buy a “Call” option for Bitcoin at USD$15,000 with a monthly contract. At the end of the month, if the price of Bitcoin is USD$20,000, you want to exercise your right to purchase it. This way, you take partial gains.

Otherwise, if the price of Bitcoin drops to USD$10,000, you’ll prefer to let your option contract expire. Of course, you will have to pay the premium you initially agreed to. This is why you need to learn to speculate to get a good profit.

Perpetual Contracts

In derivatives trading, traders can hold perpetual contracts that, as their name suggests, have no expiration date. This is the significant difference between these contracts and futures and options contracts. In some cases, a holder with a certain amount of cryptos can keep options open indefinitely. Perpetual futures contracts are the most prolific crypto derivative, especially among day traders.

How Can I Trade Perpetual Contracts?

Investing in these financial instruments is similar to investing in futures. The only difference is that perpetual contracts do not have an expiry date.

You can “go long” if the asset has a positive funding rate and “go short” as long as the crypto has a negative funding rate.

Still, it’s always recommendable to open short positions to bring back the asset and set a price closer to its actual market price.

Swaps

This last type of crypto derivatives trading involves the exchange of cash flows–in this case, currencies–at a determined date according to a formula predetermined by both parties. These are over-the-counter contracts and are traded outside exchanges or platforms.

How Can I Trade Swaps?

You cannot trade swaps in exchanges since retail investors do not engage in swaps. These contracts are generally over-the-counter (OTC).

Advantages that the Derivative Trading Provides to the Crypto Economy

Crypto Derivatives provide access to investments that, on the contrary, most investors can not. Through these contracts, buying and selling are more secure and reliable.

Crypto Derivatives Increase Liquidity

Market liquidity indicates the number of buyers and sellers interested in acquiring and selling a particular crypto and how easy it is to carry out transactions. Liquidity also means that transactions can be performed without affecting the asset’s price.

Liquid markets represent a better option for buyers and sellers who want to trade underlying assets since those are more efficient.

Crypto Derivatives Mitigate Risks

As well as the traditional derivatives market, crypto derivatives help reduce the risk brought about by a portfolio’s exposure. This is because when establishing a data and future price, you protect the assets from their own volatility and derivative market. This action mitigates the risk by freezing the value independent of the financial markets.

Cryptocurrency derivatives also help to forecast risks and market volatility where options prices are overbought. This way, traders will prefer to buy options to control the risk.

Crypto Derivatives Allow You to Buy More Cryptocurrencies

Crypto Derivatives are better than a simple spot trade since the first ones allow you to purchase cryptos with the same capital. Besides, many derivatives are made up of numerous assets of different natures. This way, institutional investors can manage substantial trading volumes.

Crypto Derivatives Diversify Portfolios

Derivatives let institutional and retail investors and other market participants diversify their investments by providing numerous crypto assets. Future contracts and other cryptocurrency derivatives allow investors to plan advanced strategies regarding future days and expand their opportunities beyond a single crypto asset. Derivatives also allow traders to hedge a portfolio for a fraction of its cost.

Besides, investors can buy different cryptos at different market prices and ensure a profit when they sell them in the crypto derivatives exchange market.

Crypto Derivatives Optimize Price Discovery

The price of a specific asset on alternative and traditional financial markets depends on many factors: liquidity, demand, information flow, etcetera. But finding out its current price is more complex.

Crypto derivatives promote market efficiency and the optimization of price discovery by letting investors adopt several strategies when investing. Buyers and sellers can go long or short, allowing the market automatically to adjust prices based on current and future contracts.

Crypto Derivatives Have Low Costs

Crypto derivatives mean a decrease in the market transaction costs since they are risk management instruments. That said, regardless of the trading volume, the transaction cost is cheaper. Then the total value of an asset has a lower price.

Crypto Derivatives Promote Efficiency

The investment of crypto derivatives is regulated by financial institutions and instruments–not in all countries–and is subject to arbitration. This control is mandatory to price the underlying assets accurately, find equilibrium, and establish a bankruptcy price.

Disadvantages of Derivatives Trading

But derivatives also bring some disadvantages you should consider when deciding to invest in digital assets.

Regulatory Concerns

There are some countries and regions in the world where derivatives are illegal, so they do not have arbitrage. In this context, the two parties must be located where derivatives are legal.

Lack of Due Diligence

In the derivatives market, traders cannot run a due diligence check on the other party due to over-the-counter trades that do not always fit strict compliance procedures.

Some Derivatives Trading Features

In this section, you’ll find some features that a designated trader can use to better leverage the crypto derivatives.

- Auto Deleveraging (ADL). When the platform cannot liquidate a position at a better price than the bankruptcy price, the ADL automatically will deleverage an opposing position.

- Stop/Loss Take Profit. This feature lets investors specify the floor and ceiling prices for a determined order. This way, they can leave the crypto derivatives market when conditions are favorable.

- Partial Close Orders. It allows traders to take partial profits while continuing to benefit from the market and specific currency by partially closing the orders.

- Insurance Funds. When holdings fall below the margin levels, this feature helps traders to prevent their funds from auto-deleveraging.

Where to Perform Crypto Derivatives Trading?

You can trade crypto derivative contracts in both centralized and decentralized platforms. A crypto derivative platform is the best place to celebrate a derivative contract since they are more flexible than a spot trading system.

Some of the best crypto derivatives trading platforms are the following:

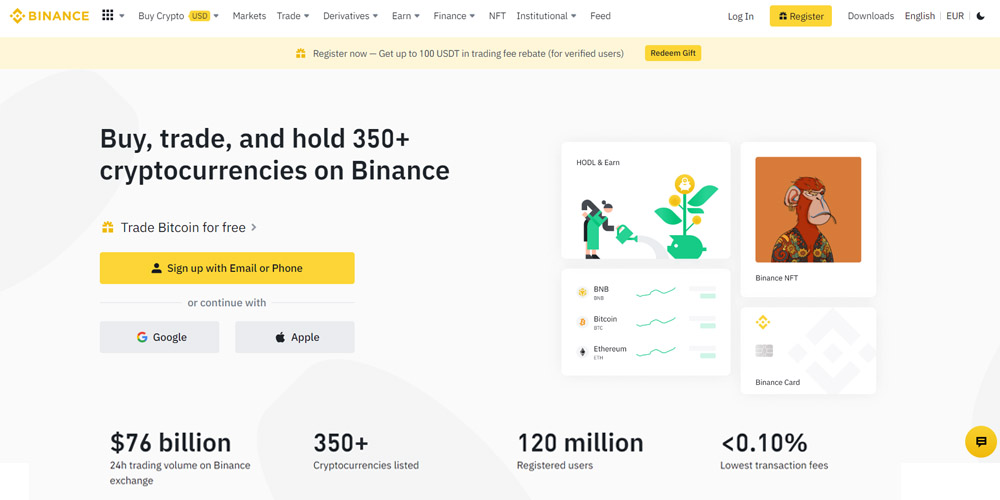

- Binance: This is the most prominent crypto derivatives exchange platform on the Internet. You can also perform exchanges in the spot market and several derivatives options.

- Bybit: This is a reliable trading platform focused on the derivatives market only. This exchange is an excellent platform to cater to crypto derivatives trading.

- Bitmex: This is another excellent platform to invest in derivatives. Bitmex offers 84 future contracts and 17 perpetual contracts.

- Deribit: This derivatives trading platform focuses on speculation in crypto features and options. It’s open to traders in more than 100 countries.

- Gate.io. This crypto exchange is recognized for offering unique products in total crypto volumes. Gate.io offers 149 perpetual contracts and several futures.

Crypto Derivative Contracts Final Thoughts

To trade crypto derivatives, you need to know all the factors involved in demand, supply, and final price. For this reason, we’ve written this article to give you a glance at the most popular types of derivatives and the benefit they can provide to the two parties, buyers and sellers.

As GamerSEO, we want to play a crucial role in spreading crypto knowledge by writing relevant articles about the cryptocurrency industry and blockchain technology. Thus, we’re continuously uploading exciting pieces of text on our blog.

We also want to help you to reach an excellent position on your Internet market with several strategies, such as SEO consultation, social media campaigns, high-quality articles, and more! Contact us via our contact form, and let’s discuss your project!

SEO enthusiast and digital marketing strategist. My expertise lies in optimizing websites for organic traffic growth and search engine visibility. I carry out, among others, SEO tests, keyword research and analytical activities using Google Analytics. Privately, he is a lover of mountains and bicycle trips.