Navigating the complexities of Google Ads in Austria requires understanding the landscape influenced by digital services tax legislation and new fees. Advertisers looking to optimize their ad spending need to consider the impact of location-based regulations and country-specific surcharges.

With ads served in Austria, the costs are subject to these additional fees, altering the traditional budgeting for campaigns. This costs guide will provide a comprehensive overview of how the new digital services tax in Austria plays a crucial role in determining your Google Ads Costs.

- Average Google Ads Cost Per Click by Industry in Austria

- Regulatory Operating Costs and DST Fees in Austria

- Surcharge Applications on Your Google Ads Account

- Where to Check For These Surcharges?

- How Are Surcharges Calculated?

- How Extra Charges Affect Your Campaigns and Budgets?

- Other Costs Affecting Google Ads in Austria

- The Top 10 Highest CPCs

- Conclusions

Average Google Ads Cost Per Click by Industry in Austria

The following Google Ads benchmarks offer insights on average industry ad costs, meaning what advertisers typically pay per click. These data, specific to Austria, are helpful if you want to gauge your campaign’s performance against others.

It’s important, though, to use these benchmarks as an extra layer of insight, not the sole indicator of success. They help you understand the ad costs in your industry, but your campaign’s effectiveness is best judged by comparing it to your own past results.

| Industry | Average CPC |

| Dating | €3.20 |

| Hotels | €3.00 |

| Flights | €2.80 |

| Jobs & Recruitment | €2.70 |

| Automotive | €2.50 |

| Moving and Cleaning Services | €2.40 |

| Banking & Finance | €2.20 |

| Electronics (E-Commerce) | €2.10 |

| Healthcare | €2.10 |

| Health & Wellness (E-Commerce) | €2.00 |

| Property | €2.00 |

| Home Appliances (E-Commerce) | €1.90 |

| Logistics | €1.90 |

| Legal | €1.80 |

| Jewelry & Accessories (E-Commerce) | €1.80 |

| Skincare (E-Commerce) | €1.70 |

| Education | €1.60 |

| Insurance | €1.50 |

| Apparel (E-Commerce) | €1.50 |

Regulatory Operating Costs and DST Fees in Austria

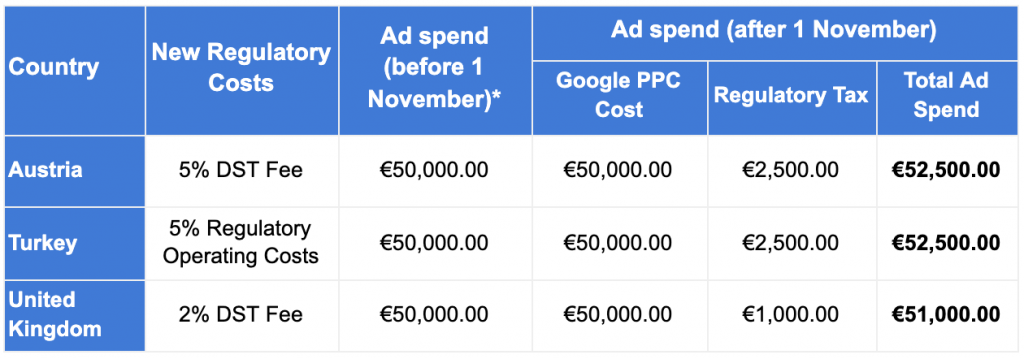

In November 2020, three countries faced a new Digital Services Tax (DST), an extra charge for Google Ads. So, for ads served in Austria, a 5% DST fee is added to the advertiser’s invoice or statement, which is part of broader Regulatory Operating Costs, signifying a shift in the financial landscape for digital advertising.

The new surcharges increase ad expenses, echoing a global movement toward taxing digital services. These specific countries are adopting such taxes showing a trend where digital services’ revenue faces extra charges.

In October 2021, other additional countries were affected by Regulatory Operating Costs, increasing the list to 7 countries that now have surcharges:

- Ads served in Austria: a 5% DST Fee added.

- Ads served in France: a 2% Regulatory Operating Cost added.

- Ads served in India: a 2% Regulatory Operating Cost added.

- Ads served in Italy: a 2% Regulatory Operating Cost added.

- Ads served in Spain: a 2% Regulatory Operating Cost added.

- Ads served in Turkey: a 5% Regulatory Operating Cost added.

- Ads served in the UK: a 2% DST Fee added.

Surcharge Applications on Your Google Ads Account

Let’s explore how taxes and fees are applied to your account budget so you can decide on the best strategy for managing your ad spend and paying your campaign bills.

- Automatic payments and monthly invoicing: Google Ads integrates surcharges at the end of your monthly invoices, which are billed in the next cycle. These additional fees are also included on top of your account budget, impacting the final billing amount. For example, for Ads served in Austria, a €100 budget with €5 in DST fee would result in a €105 charge, plus other applicable taxes like VAT.

- Manual payments or prepayments: If you pay with these methods on your automatic payments account, after the payment amount is fully spent, accumulated surcharges, such as DST fees, may lead to a balance due. This balance is then subtracted from your subsequent payment. For instance, after incurring €5 of regulatory operating costs and making a €100 deposit, your account would reflect a €95 credit for ad services, adjusting your available balance accordingly.

- For YouTube ads booked on a reservation basis: Any additional surcharges are compiled at the end of each month and included in the next billing period. These extra charges are also added to your set account budget.

Where to Check For These Surcharges?

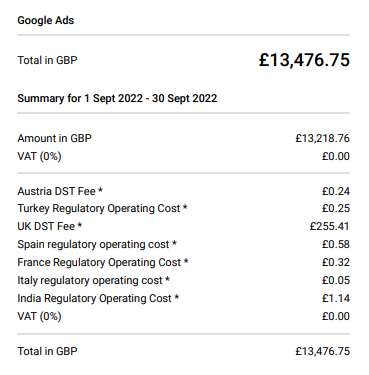

There are two ways to check the charged fees and other Regulatory Operating Costs from your ad campaigns:

- Enter your Google Ads account > click the billing icon > and click “Transactions.”

- Find them in your monthly bill or statement as separate line items per jurisdiction.

How Are Surcharges Calculated?

To better understand Google Ads costs in Austria, you must know how they are calculated. The way they’re applied involves assessing the number of ad impressions or clicks delivered within a particular jurisdiction, such as Austria, and applying fees accordingly, only in regions where DST fees and Regulatory Operating Costs are mandated.

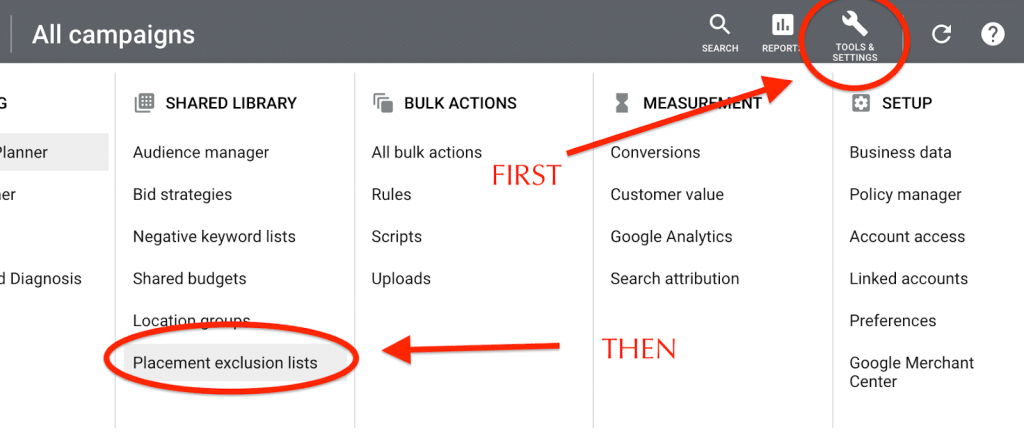

Even if your campaign doesn’t target a specific area, ads might still appear there based on user relevance, making it crucial to fine-tune your campaign settings to avoid unintended charges.

To monitor where your ads are being shown, Google Ads provides the option to generate a custom report focusing on user locations, ensuring clarity on where ad impressions land and managing your Google Ads account budget effectively.

If you discover that your ad campaigns are served in a jurisdiction you don’t want, you can explicitly exclude it from the location target setting.

How Extra Charges Affect Your Campaigns and Budgets?

When surcharges like DST fees and sales tax are applied, they can significantly alter the dynamics of an advertising campaign’s budget, particularly when the allocated funds in an automatic payments account are fully spent.

These new fees also mean significant increases in complexity that you must navigate, affecting the overall ad spend and needing a closer examination of campaign metrics.

For example, advertisers might need to reassess their strategies to accommodate the increased costs, ensuring their campaigns remain effective and within budget. This situation underscores the importance of staying informed about potential financial implications and adjusting plans accordingly to mitigate the impact of these surcharges on campaign outcomes.

Other Costs Affecting Google Ads in Austria

Beyond Regulatory Operating Costs and Austria DST fees, several additional costs can impact your overall budget strategy for your ad campaigns. So consider these costs to better understand your ad spending on the Google search network.

Hiring an Agency

Working with an agency for Google Ads management means investing not only in ad spend but also in the agency’s specialized skills to optimize campaigns and handle Google Ads’ intricacies. Agencies have experience enhancing campaign performance, and their service fees, which vary with their expertise level, come as an additional cost to the ad spend.

Device Targeting

In Google Ads, device targeting enables you to select specific devices like smartphones, tablets, or desktops for your ads, but this can impact the overall spending due to differences in user base sizes across these devices.

A larger user base means more competitive CPC rates due to a broader reach. Analyzing your audience’s device usage patterns can optimize ad spend by ensuring ads are displayed on their preferred devices, enhancing campaign effectiveness.

Google Ads API

Utilizing the Google Ads API to craft bespoke applications to oversee and analyze campaigns introduces extra expenses for businesses and developers, especially when scaling operations. Costs are influenced by the extent of operations and data handling involved.

The Top 10 Highest CPCs

The highest Cost Per Click (CPC) rates worldwide, excluding the US with an average CPC between $1 and $2, show interesting global trends in digital advertising costs. Based on the statistics found in Wordstream, the top 10 countries with the highest CPCs are:

- United Arab Emirates: CPC 8% higher than the US average.

- Austria: CPC 2% less than the US average (with a 5% Austria DST fee added)

- Australia: CPC 5% less than the US average.

- Brazil: CPC 11% less than the US average.

- United Kingdom: CPC 13% less than the US average (with 2% DST fee added)

- New Zealand: CPC 14% less than the US average.

- Chile: CPC 16% less than the US average.

- Switzerland: CPC 21% less than the US average.

- Italy: CPC 25% less than the US average.

- Canada: CPC 29% less than the US average.

Conclusions

The digital services tax and jurisdiction-specific surcharges present a nuanced challenge for businesses engaging with Google Ads in Austria. Advertisers must navigate these added costs carefully to manage effective ad campaigns without overspending.

Understanding the DST fee and its implications is essential for planning and budgeting purposes. Contact us at GamerSEO if you want expert guidance on managing Regulatory Operating costs, DST fees, and optimizing ad campaigns in this recent environment.

A PPC specialist who started with organic social media. For several years, the core of his activities are:- Google Ads, Microsoft Ads, Meta Ads, TikTok Ads, Twitter Ads, Linkedin Ads. He has led campaigns with a global reach, e.g. for FootballTeam, G2A, ETOTO, as well as many smaller campaigns in the sports, construction and financial industries. Has full focus on ROAS. Privately, a fan of football, history of wars and Star Wars.