The scalping crypto technique has been on the market for years, being a great strategy for achieving profitable trades without dealing with high volatility. This crypto trading process can give you a huge profit, especially when you understand the process and tools you can use to make crypto scalping even easier and more attractive.

Just like with other trading strategies, you must understand your goals and when to use the crypto scalping trading strategy. By doing this, you guarantee the profit from the trade setups and also have a better understanding of the technical analysis of market prices.

What Is Scalping Crypto

The crypto scalping technique is a short-term trading strategy where you make small price movements to achieve profit through the price difference between buying and selling. This trading strategy is normally used by crypto traders that use daily price movements to make small profits by making short-term trades.

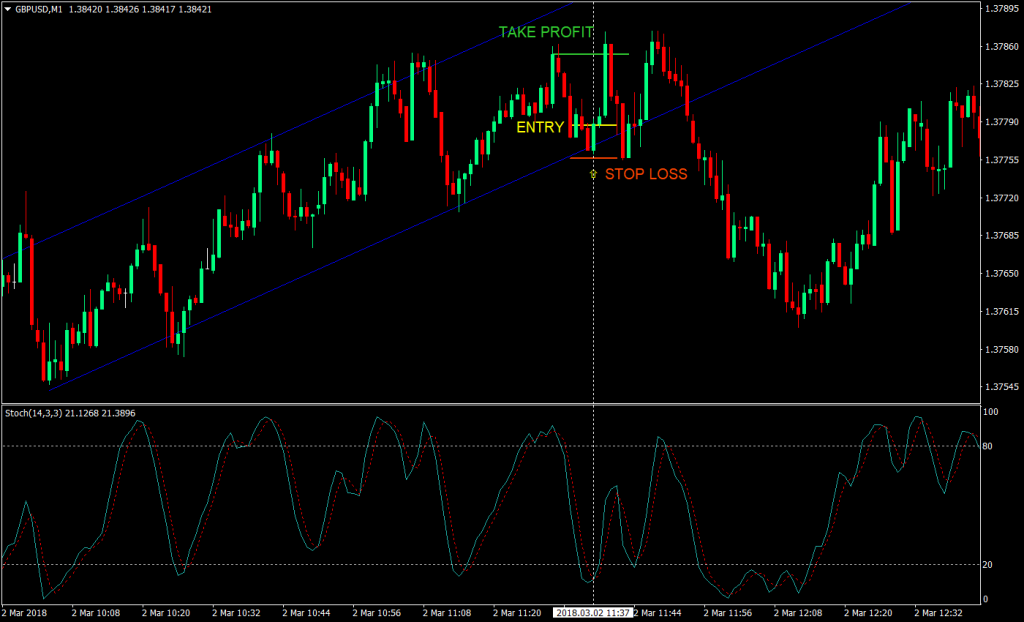

With the help of graphics and technical indicators, traders can tell the best time to make the movements and achieve successful trades. The actions may take less than minutes, depending on the coin used and the market conditions.

The main difference between scalp trading and traditional trading is that crypto scalping traders can make up to ten times more trades daily compared to normal traders. The consequence of this is that, even though the profits are considerably smaller, in the end, the trader can get profits bigger than what they would get with another trading strategy.

Why Use a Scalp Trading Strategy

With many new trading platforms and methods arising daily, it is hard to tell which is the best. The volatility of the market also impacts the decisions of the day trading process.

Since making the best deal possible in this market is the key to success and the minor price differences count, crypto scalp trading is becoming more and more the traders’ go-to option. Adopting this method allows you to avoid higher-risk deals and generate quick incomes, which can be a great option for a short-time profit.

Types of Scalp Crypto Trading

Although scalping crypto is a specific trading method, there are different types of scalp trading. Each one of these methods has different characteristics and purposes, so it is important to understand them to decide which one suits you best.

The crypto scalp trading world has many traders that use hundreds of different tools to guarantee the perfect deal. Knowing which method to use can be the key to elevating your trading volumes and ensuring a higher profit.

Range Trading

This one is probably the most common type of scalp trading. Crypto range trading involves paying attention to a coin’s price fluctuations and consistency in high and low values.

When this happens, the trader buys a high number of coins at the support level and then sells them at the resistance level. The main objective of range trading is to make a profit as quickly as possible. The final profit will be determined by the number of deals done in the day.

Bid-Ask Strategy

First, we must understand what bid-ask spread is. The bid-ask spread is the difference between the price asked for an asset and the bid price of that same token.

When doing this, the profit will come directly from the difference between those prices. This makes using external tools and bots really important to discover minor price differences quickly.

Margin Trading

Margin Trading is considered one of the riskiest strategies when it comes to crypto trading. It uses funds from third parties to make a bigger profit.

This is a hazardous option because potential losses mean they won’t be able to pay for the borrowed funds. Predicting the crypto price for this trading strategy is a hard job and one of the most dangerous methods for scalping crypto.

Scalping Time Frame

Your trading velocity and the number of trades made in a day is a scalping time frame. The faster you can do them, the better for creating several profitable trades.

The time frame for trades in crypto is really short, and the trading session typically takes less than thirty minutes, depending on your crypto trading strategy. Paying attention to the market movement and having the right tools will enhance potential gains and create more opportunities.

Trading Bots

Another often-used tool for arbitrage trading and scalping crypto, in general, is trading bots. There are dozens of different bots to help you with tasks, no matter what scalp trading techniques you use.

These bots can quickly perform tasks that we humans would have to spend hours doing, like identifying the lowest bid price of an asset or the bitcoin price. One example is the bitcoin scalper bot that performs lots of tasks to help scalpers when making trades involving bitcoins.

Here are some examples of bots that you can download right now to help you in the scalp trading process:

Demo Account

Another commonly used tool for scalpers is the creation of a demo account. This allows the traders to place virtual simulations of trades without taking any risk.

Another reason a crypto demo account is so attractive is the possibility of observing the market and its tendencies. Training your trades and seeing how things happen without the risk of losing anything is a perfect beginning before moving to a real account.

Tips For a Better Scalp Trading Experience

Despite knowing the types of scalp trading strategies, some factors can also influence your performance as a trader scalping in crypto. Those details must be decided based on your main focus as a scalp trading professional and the resources available.

Along with this, it is also important to pay attention to the market tendencies and the trading fees of each one. Doing this will help you define the best scalping strategy for you, helping you when day trading coins.

The Platform

One of the most crucial factors for scalp traders to succeed is the trading platform choice. There are dozens of different places for crypto scalping available throughout the internet, each one with its own particularities.

Choosing the right one for your needs is a big step in starting to make small profits as a crypto scalper. Each trading platform has its trading fees and analysis tools, so be sure to use the one that best suits your expectations.

Data Accuracy

Perhaps the most important part of the crypto scalping strategy. An up-to-date database, with real-time updates and clear data, is a big part of the process.

Scalp traders use these data as the base for making decisions in day trading. The crypto market is volatile and constantly changing, so it is crucial to have good data accuracy to guarantee the best decisions on what to do.

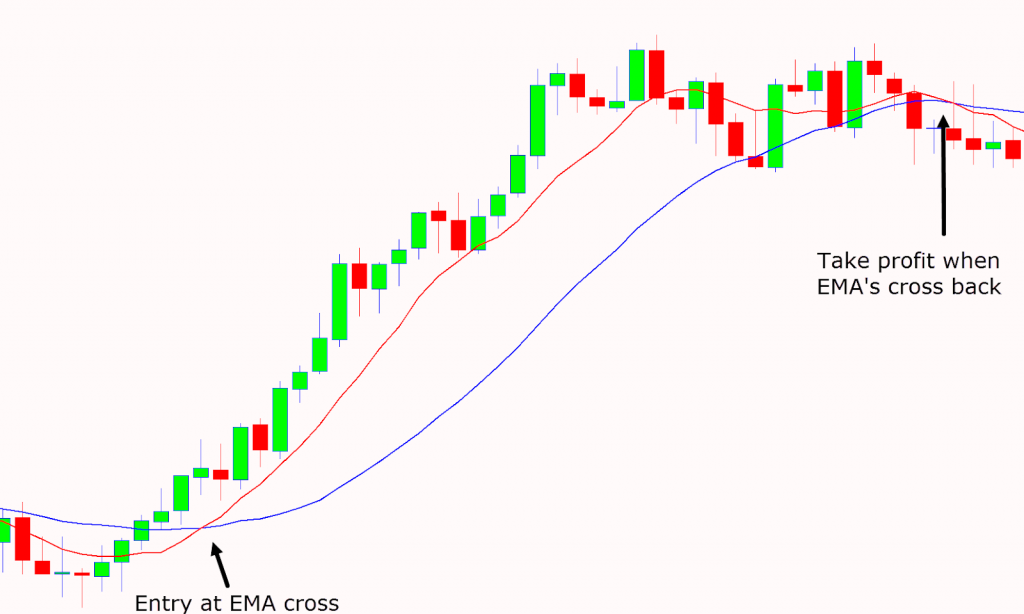

Moving Average

Another important factor that you should consider when planning your next trade. The moving average shows the scalper the average price of a token over a specific period.

When analyzing this, you can tell where the price is moving to. These technical indicators tell the best time to buy a new coin or asset.

Relative Strength Index

The RSI tells you the strength of a trend and how easily its prices might change. The evaluation of the potential is done by analyzing failure swings and divergence in the trades and sales.

Although it’s not the most critical data, it is very important to pay attention to the strength of those trends and have a general idea of them. This tool is very handy, especially when you are swing trading.

How to Guarantee Success and Profit as Scalp Traders

Some practices and characteristics will help you become a successful trader. These tips help you improve your job and guarantee minimum money and time loss, whether you are range trading or margin trading.

Pay Attention to High Trading Fees

Some marketplaces charge giant fees for the user to trade crypto assets. Paying attention to this detail and choosing crypto markets with lower fees is a big step to enhancing potential gains as scalp traders.

Another reason fees can become a huge problem is the high volume of trades that the scalping strategy typically implicates, even if the fees are low. Crypto scalping strategies normally involve dozens of tradings daily, and when you sum every fee, it ends up being a huge amount of money.

Be Careful When Spending

We know how unstable prices are in the crypto world, which requires extra care when deciding where to invest. Spending all of your money on a single coin is normally a bad deal.

Having the right tools to monitor price fluctuations is one of the most important steps to start saving money. These tools prevent the investor from engaging in deals that are risky and don’t give a guarantee of profit.

Fast and Consistent

One of the most important characteristics of being a scalp trade crypto professional is consistency and speed when analyzing and trading actions. Everything changes within seconds, from price movement to support and resistance levels, demanding a high focus and a clear fundamental analysis to make good deals.

Best Crypto for Beginners

Many coins and assets are available to trade online, and deciding which one to start with might be tough. There is no right answer for this since it will depend on your trading style and strategy.

Beginners normally choose bitcoin as their first asset to the scalp. This token is usually way less volatile than the others. Another reason is the huge variety of materials to study involving the bitcoin market, from books to a specific bitcoin scalping blog.

Is Crypto Scalping Worth It?

The crypto world seems like a promising market with huge income potential, but also very risky. This is why the scalping strategy is so welcome, being a solution to many investors that want to participate in the crypto world but with lower volatility and risk.

Of course, on the other hand, the price movements are lower, and so are the profits. But this isn’t bad if you think of safety compared to other traditional strategies.

The other reason this is a great option is the variety of different types to experiment with. Even though scalping is only one strategy, there are various possible ways of doing this same thing.

Ready to Become a Master in Scalp Trading?

No matter what scalping strategies you are thinking of following, having knowledge of the process and paying attention to the market tendencies are the keys to becoming a good trader.

Also, don’t be afraid to try new strategies, platforms, or other things. The first step to knowing what suits you best is trying as many possibilities as possible.

Be sure to follow the tips and plan your next steps. Doing this guarantees that you have all the data needed to make the best decisions as an investor and generate profits.

SEO enthusiast and digital marketing strategist. My expertise lies in optimizing websites for organic traffic growth and search engine visibility. I carry out, among others, SEO tests, keyword research and analytical activities using Google Analytics. Privately, he is a lover of mountains and bicycle trips.