Several factors related to NFT and cryptocurrency trading take the sleep of crypto traders, mainly inexperienced beginners. One of these factors is slippage in crypto. This widespread phenomenon can come for good and evil, but, at most times, it makes investors lose money. After all, what is slippage in Crypto, and why can it become a problem for crypto traders?

Investors must understand that crypto trading is a relatively new and volatile market. This makes the crypto fluctuation extremely hard to predict, as even the most experienced investors may not know what to expect at some times. This can end up causing price slippage in a trading platform.

You can have positive or negative slippage, depending if you are making a sell or a buy order and on the prices of popular cryptocurrencies you are looking for. Considering that slippage can be seriously problematic to your investment, GamerSEO prepared a complete article to ensure you understand what it is and how you can avoid or, at least, minimize slippage.

Defining Slippage

Slippage is the difference in the price of a cryptocurrency when you place your market orders and when the crypto market finishes. Clarifying, when you place your buy or sell orders, you see a specific value for the crypto you want to buy or sell.

This is your expected price. But the value you will receive is the cryptocurrency’s market price when the crypto market finishes the transaction, what we can call the execution price.

We know a trader expects to receive the value they see at the moment, but slippage matters a lot, and you must consider it in your trading strategies. This, alongside other factors, can be just the difference between success and failure in trading.

Why Does Crypto Slippage Occur?

Price fluctuation is normal for cryptocurrencies, but ideally, in the short time between you placing your market order and this order execution, it will not change. But two main reasons can generate price slippage. Price slippage occurs due to volatility and liquidity, and we will look at both.

Slippage happens in all kinds of crypto markets and with all sorts of decentralized exchanges. Of course, there are ways to establish a low slippage tolerance to avoid slippage when trading cryptocurrencies.

Another possibility is to make a slippage calculation to avoid trading in disadvantageous circumstances, holding your assets until they are worth higher prices. You can always try to calculate slippage when trading crypto to prevent potential losses, but taking full advantage of slippage is only for a more experienced investor.

Volatility

This type of slippage happens due to a high sell or buy volume. Price volatility means precisely that: changes in high frequency. Sometimes you work with volatile markets, and the trade volume is so high that the price changes and the order executes in a different value.

Liquidity

The best definition of liquidity is the ease with which a cryptocurrency can be converted into another digital asset or cash without impacting the price of this NFT or cryptocurrency. Considering this definition, you can see how volatility and liquidity are related.

Anyway, cryptocurrencies with low liquidity tend to be more volatile, having more impact on each transaction. On the other hand, cryptocurrencies with high liquidity change less. Well-known and established cryptocurrencies, such as Bitcoin or Ethereum, have higher liquidity, as their liquidity pools are big.

Positive and Negative Slippage

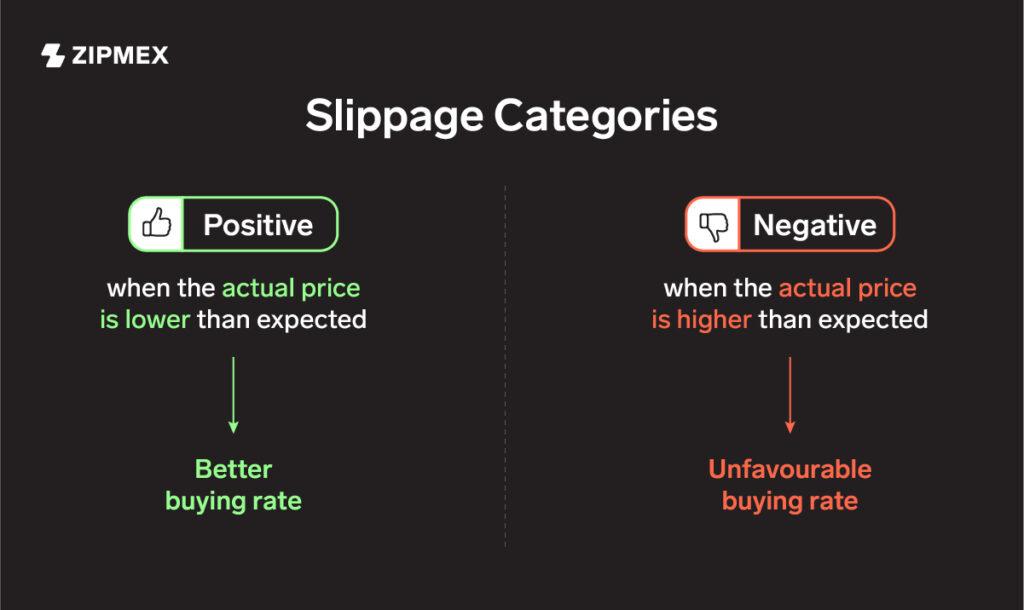

Most investors tend to treat slippage as a bad thing. But, theoretically, there are two types of slippage – positive slippage and negative slippage. That’s because slippage can make you pay a higher or lower price. They depend on the fluctuation of the cryptocurrency you are exchanging experiences and the type of market order you place. Let’s see the differences.

Positive Slippage

The positive Slippage occurs when you buy a cryptocurrency, and the digital asset fluctuates above while the order enters the system, making the actual price higher than the expected price. If you place a sell order, you have a positive slippage if your currency gains value between the order placement and execution.

This slippage percentage change will become a larger quantity of cryptocurrency, return part of your payment, or produce a more significant income. All of that is considering that the intended price will be better than the exact price for the transaction.

Negative Slippage

On the other hand, what has been considered negative slippage is pricing drops while selling and increases while buying. In other words, when you place a buy order and the price increases before it is completed. It also happens when you place a sell order and the price of your cryptocurrency or digital asset goes down with market pricing.

Calculating Slippage

If you want to know how much you won or lost due to slippage, you can calculate it with a simple mathematical operation. This is helpful for you to control your finances, no matter if we are talking about a lower or a higher price. A better price means you received more money for the asset you sold, so you may need to consider that specific price in your calculations.

To calculate slippage in a fiat currency, such as the dollar, you just need to subtract the price you expected from the actual price you received. If you want to do the math in percentages, the operation changes.

To have the correct percentages, divide the dollar amount of slippage by the difference between the price you expected to get and the worst execution price possible. After that, you just need to multiply it by 100. There you go, the percentage is found.

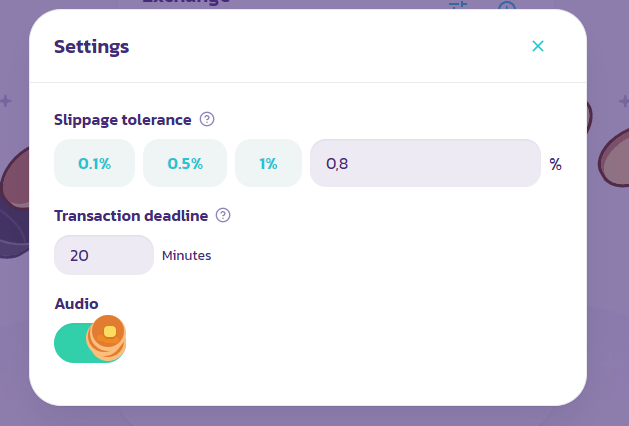

Slippage Tolerance

Sometimes, your interest in a cryptocurrency depends strictly on the specific price you’re paying. This means slippage can turn a good business into a bad one. You need to establish limit orders to ensure you will have the expected slippage or will automatically cancel the transaction. They will not eliminate slippage, but configuring a tolerance percentage will save you from significant fluctuations.

Most crypto markets allow you to set your slippage tolerance. It will ensure your transaction is completed only if the slippage doesn’t exceed the previously established values. If you configure a high slippage tolerance, you will have a preference in disputes since you are accepting to pay more for assets.

A lower tolerance will take you out of disputes but prevent you from investing too much when the asset gets a worse price. You have all that with a simple limit order to reduce slippage and avoid the transaction if the price rises too much.

Ways to Avoid Slippage

So far, you already understand how fast-changing prices can be a problem, as buying or selling assets for a different price than expected is frustrating. Of course, several factors interfere in the buying or selling, such as how much gas you add to each transaction. But keeping our article strictly related to slippage, it is time to check some measures you can take to avoid more significant slippage. Actions that go beyond just setting your slippage tolerance.

Avoid Trades and Transactions During Volatile Moments

As you gain experience in the crypto market, you will see that some specific periods make cryptocurrencies and NFTs more volatile than others. Particular periods when big investors tend to buy or sell assets in higher volume will make cryptocurrencies’ values increase and decrease fastly, representing a higher risk for buyers and sellers.

These crypto exchanges affect liquidity and volatility, which means profits are not guaranteed. So, if you’re unable to determine how the market will behave, it will be better not to invest.

Another thing that may affect decentralized and even centralized exchanges is important Governments decisions about such markets, which is also a common occurrence. Countries like China and the USA can increase their taxes on these digital assets, making any market price drop fast. It will be better to wait to buy any cryptocurrency when they recover and have a better buying rate, for instance.

Invest in Popular Asset Classes

Investing in well-established crypto is another way to control slippage in your transactions. That is because these investments have enough liquidity to hold on, no matter the buying power of any investor.

This means that nothing will happen while the market finishes your operation, keeping the current price at the same value as you originally intended. Bitcoin is a good example. Since the cryptocurrency is hugely famous and stable for standard patterns, the value of one bitcoin will not change during the transaction, and your slippage tolerance will be respected.

Conclusions

Even though they are pretty simple, some aspects directly related to slippage are a problem for new investors. Such elements include slippage tolerance, market and limit orders, and low liquidity.

You must understand why slippage matters so much in a decentralized exchange and know all the related terms and actions. And, thanks to this complete GamerSEO article, questions such as “How does slippage work?” aren’t a problem.

If you want to know more about NFTs, Cryptocurrencies, Metaverse, and many other topics about gaming and the digital universe, check GamerSEO. We have great quality articles to answer all your questions.

Besides that, if you need help with content production for your business website or blog, contact us! We are more than pleased to help you develop your business and achieve success.

SEO enthusiast and digital marketing strategist. My expertise lies in optimizing websites for organic traffic growth and search engine visibility. I carry out, among others, SEO tests, keyword research and analytical activities using Google Analytics. Privately, he is a lover of mountains and bicycle trips.